Rent freezes are becoming an increasingly popular way for governments to address skyrocketing rental prices. In New Zealand, rent freeze legislation was implemented in 2020 in response to the COVID-19 pandemic with varying results. While rent freezes may provide immediate relief to tenants, it’s important to consider the potential disadvantages before making a decision about whether implementing them is the right solution. This article looks at the possible drawbacks of rent freezes in order to give a balanced overview of how these policies could affect both landlords and renters.

Rent in New Zealand is a pressing issue, with many Kiwis feeling the burden of the increase in their largest household expense (mortgage/ rent) and limited access to affordable rentals (Household Expenditure Guide, n.d.). This pressure has only grown as costs of living have risen, leaving more people struggling to stay up-to-date on their rent payments. The demand for rental accommodation has also surged; Statistics New Zealand’s latest Rental Price Index reported a 4.1% rise in tenancy registration in October 2022 (“Rental Price Indexes: September 2022 | Stats NZ,” 2022), demonstrating the magnitude of this problem.

Rising rents

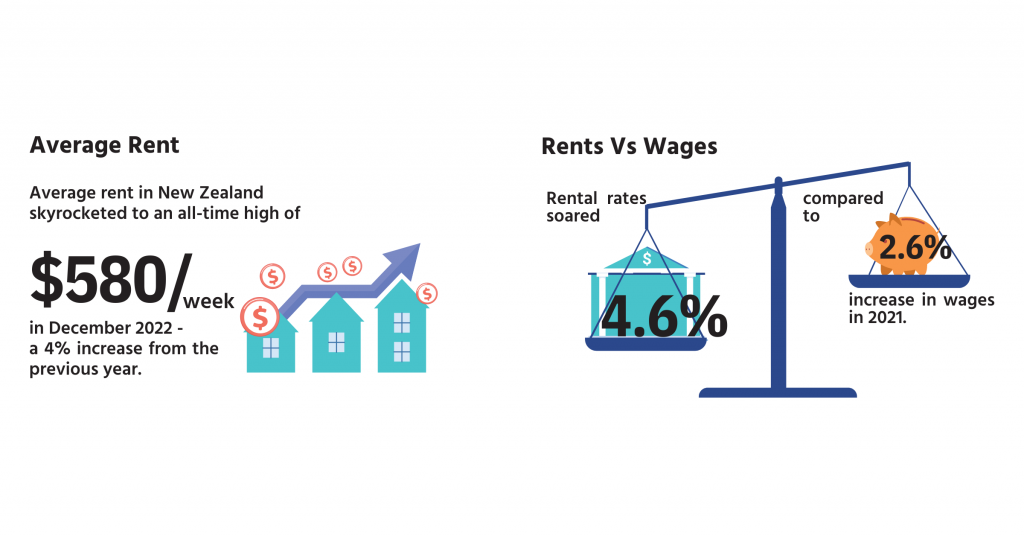

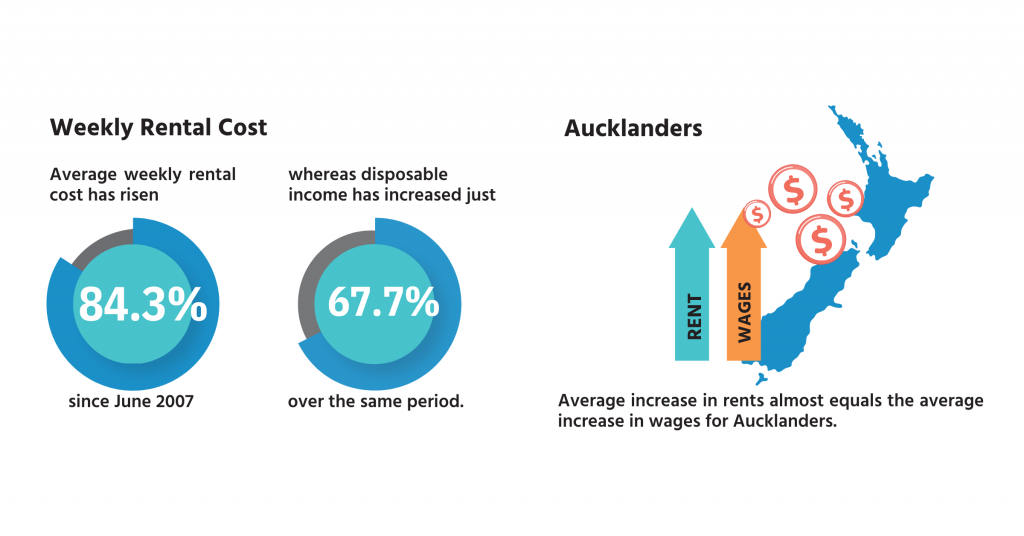

The rental landscape in New Zealand has seen considerable growth over the past few years. According to Trade Me Property (2022), average weekly rent across the country was NZ$580 in December 2022 – a 4% increase from December 2021, and an all-time high. The trend of rental rates growing faster than wage growth is continuing: between 3.2% and 7.8% for rental rates compared to 2.6% for wages, as reported by Statistics New Zealand (“Rental Price Indexes: September 2021 | Stats NZ,” 2021; “Labour Market Statistics: December 2021 Quarter | Stats NZ,” 2021). In cities such as Auckland, increases in rents are almost equal to the take home pay (“Rents Are Rising Faster than Wages in Auckland & Wellington but Falling in Christchurch,” 2018)

This is a situation that has been worsening since June 2007 where monthly rental costs have risen 84.3% as compared to a 67.6% increase in household disposable income over the same period (“Housing Costs Rise, Impact Felt Strongly by Renters | Stats NZ,” 2023). The surge in rental costs can be attributed to a high demand for housing stock and a shortage of rental properties across the country.

Influencing factors

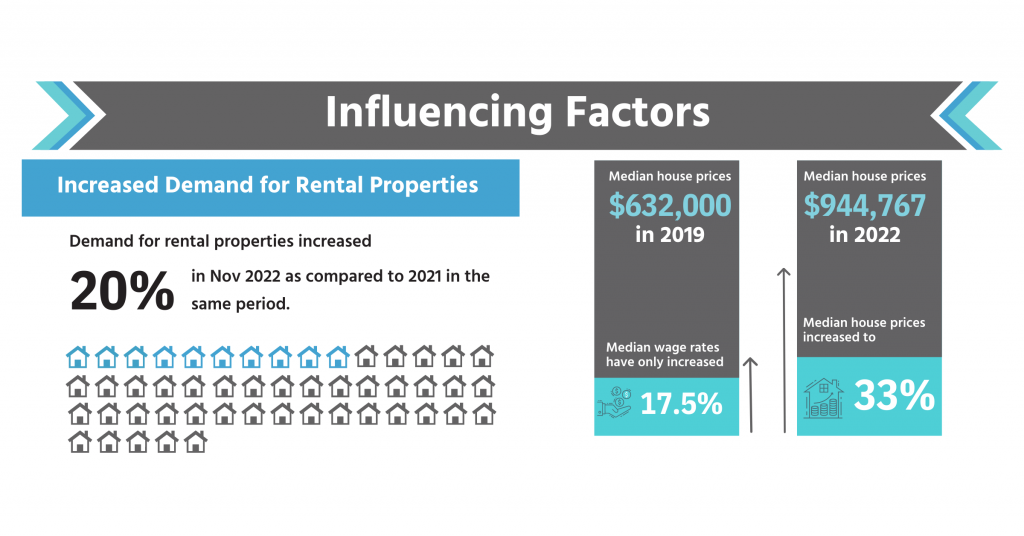

Increased demand for rental properties

The demand for rental properties in New Zealand has seen a steady increase up until the end of 2022, when it experienced a slight decrease. Despite this temporary dip in interest, Trade Me Property reported that rents rose by 4% during the same period (2022). This surge in rental demand is largely attributed to higher house prices and more Kiwis facing difficulties with home ownership. To illustrate this, Real Estate Institute of New Zealand (REINZ) showed that median house prices skyrocketed 33%, from NZ$ 632,000 to NZ$ $944,767 between 2019 and 2022 respectively(NZ, 2020; (“QV House Price Index,” 2023). In contrast median weekly earnings only increased 17.5% in this same period(“Labour Market Statistics (Income): June 2022 Quarter | Stats NZ,” 2022). This trend suggests that the rise in rents will continue as long as homeownership remains out of reach for many people.

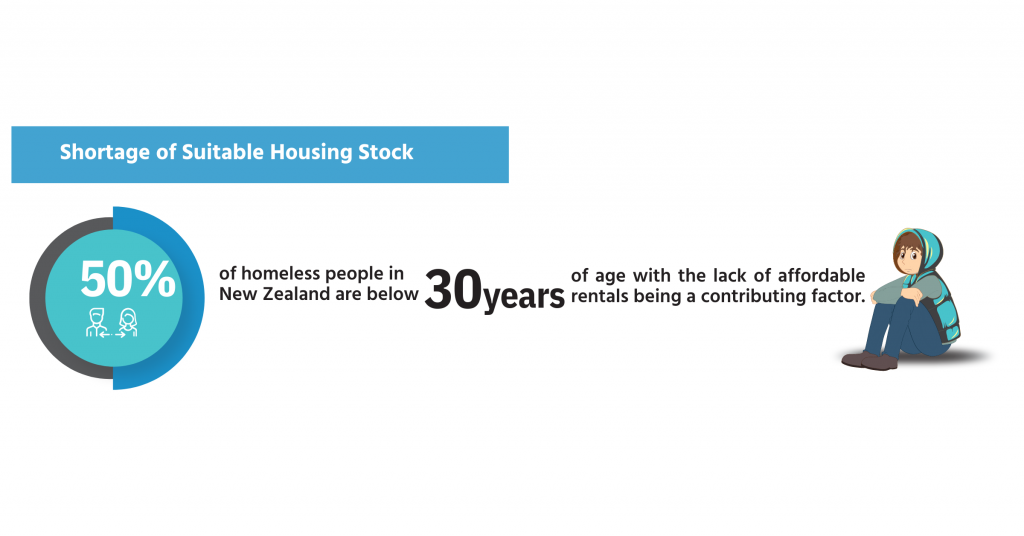

Shortage of suitable housing stock

The shortage of suitable housing stock in New Zealand has been ongoing since early 2000s, (Shamubeel Eaqub, 2022) but is now reaching a critical level. In fact, lack of housing has become a human rights issue in New Zealand that demands a human rights response. For example, one in 100 people in New Zealand are homeless. Almost 50% of these homeless people are below 30 years of age (“New Zealand – Homeless Population in Auckland by Age Group 2018 | Statista,” 2018;“New Zealand: Housing Crisis Requires Bold Human Rights Response, Says UN Expert,” 2020). This shortfall is primarily due to an imbalance between demand and supply, with too few new houses being built while demand continues to increase, especially for those on low incomes who require social or more affordable housing (Council, 2019)

The housing situation in New Zealand is dire; rent prices have been rapidly increasing since 2007 and demand for rental properties consistently remains high (“Labour Market Statistics: December 2021 Quarter | Stats NZ,” 2021). Unfortunately, the shortage of suitable housing stock and lack of affordable rentals has created an unsustainable living environment for many Kiwis. It is evident that immediate action needs to be taken by both the government and private sector in order to improve the current rental landscape in New Zealand.

Can rent freezes buffer low incomes over rising rental costs

Rent freezes are a popular policy instrument used to stabilise rent prices and provide renters with temporary relief. Though these policies exist in various forms, they generally limit the amount of rent increases landlords can impose on tenants annually. International implementations of this measure have met with mixed success; New Zealand’s six month freeze during the COVID-19 pandemic saw a sharp increase in rents after its expiration. Subsequently, it is essential to understand both the potential benefits and drawbacks of rent freezes before implementing them.

What are the advantages of rent freezes

The main advantage of rent freezes is that they provide some financial security for tenants who would otherwise find it difficult to keep up with increasing rents. Some studies in the USA (Sims, 2007) and Germany (Breidenbach et al., 2022) have shown that rent freezes or controls reduce rental rates paid by tenants. Breidenbach et al. (2022) found that rent control dampened rental prices by 5% for all dwellings and up to 9% for specific types of dwellings. Such reductions could be utilised elsewhere for tenants such as food or clothing, in particular, for those on lower incomes where rent makes up the majority of their expenses.

Rent freezing policies, especially those that reward landlords who invest in property maintenance or allow rent increases only if landlords perform quality upkeep could also give landlords some reassurance that their income will be stable over the course of the freeze period. This stability can encourage investment in the rental market and potentially lead to more available housing stock. This increased supply can help to reduce rental costs in the long term, as landlords may have incentive to offer lower rents when competition for tenants increases (Rajasekaran, Treskon, & Greene, 2019).Hence, rent freezes could also be used by governments to incentivise landlords and developers to build new housing stock or make existing properties more affordable.

Finally, rent freezes provide an opportunity for government and industry stakeholders to come together and develop a comprehensive plan for addressing the underlying causes of not just rising rent prices—such as lack of suitable housing stock or inadequate regulation but also the causes behind socioeconomic inequality because rent freezes have also been found to reduce social as well as economic inequality in many countries (Kholodilin & Kohl, 2022).

What are the disadvantages of rent freezes

Despite the potential benefits, rent freezes can also cause a number of problems. The most obvious disadvantage is that they reduce the income of landlords, who may find it difficult to cover necessary costs and maintenance if their rents are frozen for an extended period. This could lead to a decline in standards in existing rental properties and undermine efforts to improve housing quality and safety. Additionally, rent freezes could discourage investors from entering into the rental market as they may be put off by the prospect of not being able to increase their income over time (Arnott & Shevyakhova, 2014; Rajasekaran et al., 2019). This could also affect the supply of available rental units. In a study in San Francisco, Diamond, McQuade, & Qian (2019) found that expansion of rent controls led to a 25% decline in rental units.

There are also concerns that rent freezes can distort market forces and potentially lead to higher rents when the moratorium period comes to an end. If landlords have been unable to recoup some of their costs due to the freeze, they may be inclined to increase rents as soon as the freeze is lifted in order to recoup their losses (Early, 2000). This could lead to short-term rent hikes that could further exacerbate the affordability crisis and make it even more difficult for renters to find suitable housing. Diamond et al. (2019) revealed that the reduced number of rental units was a reason behind driving up market rents. More specifically, the authors found that the rent control law in San Francisco led to a 5.1% increase in rents from a period ranging 1995-2012 after rent controls came into force. Moreover, in New Zealand there was up to a 11% increase in average rents once the 2020 COVID-19 six month rent freeze was lifted (Newton, 2021)

Finally, rent freezes can be an unfair policy tool when applied too broadly. For example, if a blanket rent freeze is imposed across all properties regardless of quality or location, higher-quality rental properties may suffer from reduced demand as tenants opt for cheaper alternatives. Similarly, landlords who have invested heavily in making their properties energy efficient or providing additional services may struggle to benefit from the freeze period due to competing options with lower rents on offer and may also be deterred from investing in energy efficient homes (“Stars and Standards: Energy Efficiency in Rental Markets,” 2012).

Conclusion

Rent freezes can be an effective way for governments to address rising costs of rental accommodation. However, it is important that policies are carefully considered with all implications taken into account in order to ensure unintended consequences are avoided. Incentivising landlords through rewards, subsidies, and tax credits could help to encourage rent freezes on top of ongoing investments and maintenance. But ultimately, rent freezes should be part of a comprehensive policy package that addresses the underlying causes of increasing rents in New Zealand like lack of suitable housing stock and inadequate regulation. With proper consideration and implementation, rent freeze policies can be a powerful tool for improving the path towards home ownership.

References

Arnott, R., & Shevyakhova, E. (2014). Tenancy rent control and credible commitment in maintenance. Regional Science and Urban Economics, 47, 72–85. https://doi.org/10.1016/j.regsciurbeco.2013.08.003

Breidenbach, P., Eilers, L., & Fries, J. (2022). Temporal dynamics of rent regulations – The case of the German rent control. Regional Science and Urban Economics, 92, 103737. https://doi.org/10.1016/j.regsciurbeco.2021.103737

Council, A. (2019). Homelessness in Auckland. Retrieved February 12, 2023, from Auckland Council website: https://www.aucklandcouncil.govt.nz/plans-projects-policies-reports-bylaws/our-plans-strategies/auckland-plan/homes-places/Pages/homelessness-auckland.aspx#:~:text=A%20key%20driver%20is%20a,not%20traditionally%20been%20at%20risk.

Diamond, R., McQuade, T., & Qian, F. (2019). The Effects of Rent Control Expansion on Tenants, Landlords, and Inequality: Evidence from San Francisco. American Economic Review, 109(9), 3365–3394. https://doi.org/10.1257/aer.20181289

Early, D. W. (2000). Rent Control, Rental Housing Supply, and the Distribution of Tenant Benefits. Journal of Urban Economics, 48(2), 185–204. https://doi.org/10.1006/juec.1999.2163

Household Expenditure Guide. (n.d.). Retrieved from https://www.ird.govt.nz/-/media/project/ir/home/documents/forms-and-guides/ir100—ir199/ad164/2020.pdf?modified=20200907050256&modified=20200907050256

Housing costs rise, impact felt strongly by renters | Stats NZ. (2023). Retrieved February 12, 2023, from Govt.nz website: https://www.stats.govt.nz/news/housing-costs-rise-impact-felt-strongly-by-renters/

Kholodilin, K., & Kohl, S. (2022). Rent control reduces economic inequality at a price. Deutsches Institut Für Wirtschaftsforschung, 12(12). https://doi.org/10.18723/diw_dwr:2022-12-1

Labour market statistics (income): June 2022 quarter | Stats NZ. (2022). Retrieved February 12, 2023, from Govt.nz website: https://www.stats.govt.nz/information-releases/labour-market-statistics-income-june-2022-quarter/

Labour market statistics: December 2021 quarter | Stats NZ. (2021a). Retrieved February 12, 2023, from Govt.nz website: https://www.stats.govt.nz/information-releases/labour-market-statistics-december-2021-quarter

Labour market statistics: December 2021 quarter | Stats NZ. (2021b). Retrieved February 12, 2023, from Govt.nz website: https://www.stats.govt.nz/information-releases/labour-market-statistics-december-2021-quarter

New Zealand: housing crisis requires bold human rights response, says UN expert. (2020). Retrieved February 12, 2023, from OHCHR website: https://www.ohchr.org/en/press-releases/2020/02/new-zealand-housing-crisis-requires-bold-human-rights-response-says-un

Newton, K. (2021, January 26). Rents soar after Covid-19 freeze ends. Retrieved February 12, 2023, from Stuff website: https://www.stuff.co.nz/life-style/homed/renting/124052014/rents-soar-after-covid19-freeze-ends

NZ, in. (2020, December 10). REINZ BLOG. Retrieved February 12, 2023, from REINZ BLOG website: https://www.blog.reinz.co.nz/blog/nov-stats-2020

QV House Price Index. (2023). Retrieved February 12, 2023, from Qv.co.nz website: https://www.qv.co.nz/price-index/

Rajasekaran, P., Treskon, M., & Greene, S. (2019). Rent Control What Does the Research Tell Us about the Effectiveness of Local Action? Urban Institute, 1–12. Research to Action Lab. Retrieved from https://www.urban.org/sites/default/files/publication/99646/rent_control._what_does_the_research_tell_us_about_the_effectiveness_of_local_action_1.pdf

Rental price indexes: September 2021 | Stats NZ. (2021). Retrieved February 12, 2023, from Govt.nz website: https://www.stats.govt.nz/information-releases/rental-price-indexes-september-2021

Rental price indexes: September 2022 | Stats NZ. (2022). Retrieved February 12, 2023, from Govt.nz website: https://www.stats.govt.nz/information-releases/rental-price-indexes-september-2022/

Rents are rising faster than wages in Auckland & Wellington but falling in Christchurch. (2018). Retrieved February 12, 2023, from interest.co.nz website: https://www.interest.co.nz/property/89206/aucklanders-caught-between-high-rent-increases-and-low-wage-growth-high-immigration

Shamubeel Eaqub. (2022, November 23). Pulling Many Levers: Banking, borrowing and building need to change to make housing in New Zealand affordable. Retrieved February 12, 2023, from The OECD Forum Network website: https://www.oecd-forum.org/posts/pulling-many-levers-banking-borrowing-and-building-need-to-change-to-make-housing-in-new-zealand-affordable

Sims, D. P. (2007). Out of control: What can we learn from the end of Massachusetts rent control? Journal of Urban Economics, 61(1), 129–151. https://doi.org/10.1016/j.jue.2006.06.004

Stars and standards: Energy efficiency in rental markets. (2012). Journal of Environmental Economics and Management, 64(2), 153–168. https://doi.org/10.1016/j.jeem.2012.05.002

Trade Me. (2022, December 20). Rents remain at a record high as regions boom. Retrieved February 12, 2023, from Trademe.co.nz website: https://www.trademe.co.nz/c/property/news/rents-remain-at-a-record-high-as-regions-boom