At Matada, we understand that personal debt can have a significant impact on the health and well-being of individuals, especially those in low-income brackets. Taking out loans or using credit cards to purchase goods and services can quickly become unmanageable, leading to difficulty with repayment and negatively affecting mental and physical health. As a social enterprise specialising in transformative research, evaluation, consultation, and program development, we aim to provide innovative solutions to help people manage their debt responsibly. In this article, we will discuss how personal debt affects health and well-being, and provide three policy solutions to address excessive debt for low-income households. Our mission is to enhance the well-being of individuals, communities, and society, and we are committed to building positive relationships with our clients. If you are interested in exploring further solutions to this complex problem contact us here.

What is debt, and what is considered too much debt?

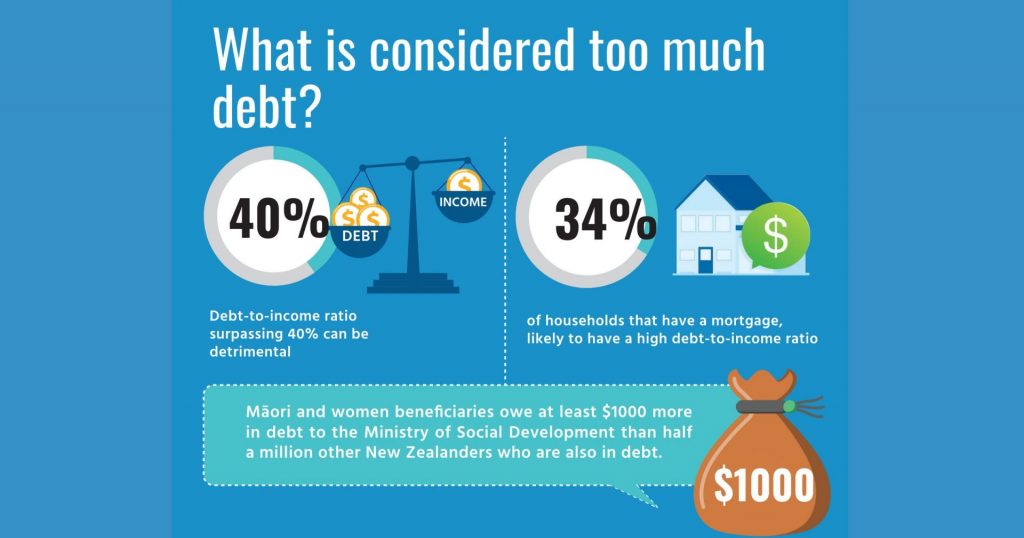

Debt is an overarching term used to describe a situation where an individual or entity owes money to another. It can take many forms, ranging from credit card debt, personal loans, student loans, car loans, and mortgages. Determining when a person’s debt becomes unmanageable can be challenging since it hinges on multiple factors, including income, expenses, and financial objectives. However, it is widely acknowledged that when a person’s debt-to-income ratio surpasses 40%, their debts have become untenable. The debt-to-income ratio is a metric that assesses how much an individual disburses monthly relative to their monthly earnings. For instance, if someone makes $2,000 a month and has monthly payments of $800, their debt-to-income ratio would push them to the brink of their income.

New Zealand’s debt-to-income ratio has been a subject of concern as it increased from 158% in 2019 to 169% in 2021, as reported by the International Monetary Fund (2022). The primary driver of this high ratio is the housing market, with approximately 34% of households that have a mortgage, likely to have a high debt-to-income ratio. However, this problem is not evenly distributed, with certain demographics more affected than others. Families, females, Māori, and Pacific people are among those who are worst affected by debt. This fact is supported by the Ministry of Social Development’s data on debt relief loans, which shows that a significant number of this population accessed such loans, particularly during the pandemic. In particular, Māori and women beneficiaries face higher weekly debt repayments than their Pakeha and male counterparts, as they owe at least $1000 more in debt to the Ministry of Social Development than half a million other New Zealanders who are also in debt (Dreaver, 2021).

In recent years, a lending scheme that has garnered significant attention is the “buy now pay later” (BNPL) approach. It permits borrowers to split a loan into smaller, interest-free instalments and pay it off over an extended period. This approach has seen remarkable growth in New Zealand, with usage increasing by 49% in 2021 compared to the previous year (Pointon, 2021). While these schemes can offer the convenience of purchasing items on credit at no apparent cost, it is vital to note that they remain unregulated, and borrowers must exercise caution when using them. Careless usage of these schemes can result in borrowers becoming trapped in a cycle of debt, with the potential to adversely affect their mental health (Stock, 2022).

How does too much debt affect health and wellbeing?

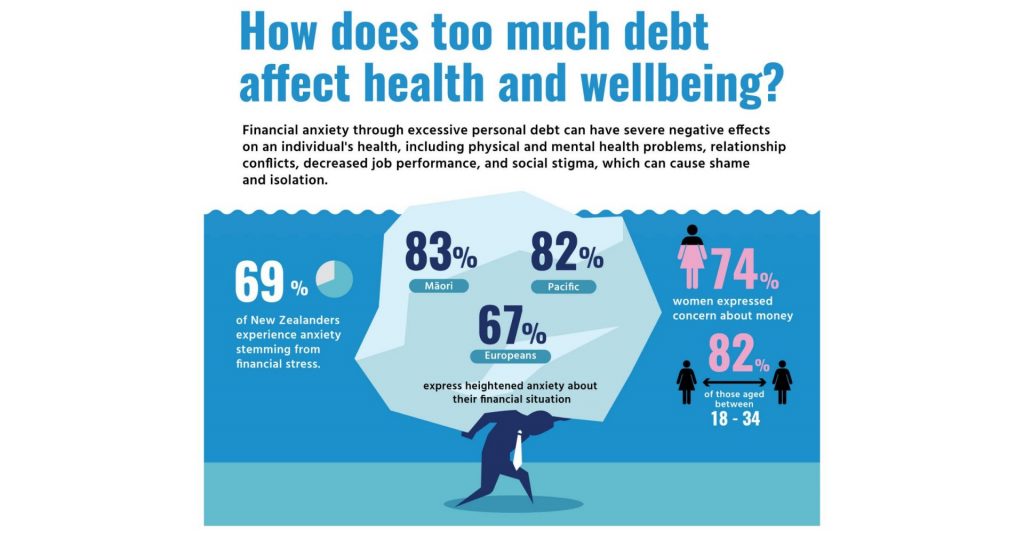

Excessive personal debt can wreak havoc on an individual’s health and wellbeing, causing a host of physical and mental health problems. Chronic stress and anxiety, resulting from financial worries, can take a toll on one’s mental health, leading to issues like depression, insomnia, and panic attacks. Additionally, financial issues are a primary source of relationship conflict, which can have a negative impact on both partners. The strain of overwhelming debt can also result in physical health issues such as headaches, high blood pressure, and gastrointestinal problems. Poor job performance due to financial stress can lead to decreased productivity, absenteeism, and even job loss. Unfortunately, the social stigma associated with being in debt can make it difficult for individuals to seek help, causing feelings of shame and isolation.

The Retirement Commission conducted a study in 2019, which highlights the pervasive and deleterious effects of financial worries on the New Zealand population. The study reveals that a significant 69% of New Zealanders experience financial anxiety stemming from financial stress. Interestingly, this concern is more pronounced among women, with 74% expressing worry, as well as those aged between 18 and 34, where the figure jumps to 82%. Moreover, the study sheds light on the disproportionate impact of financial concerns on Maori and Pacific communities. An alarming 83% of Maori and 82% of Pasifika individuals express heightened anxiety about their financial situation, compared to 67% of New Zealand Europeans. This stress can have profound health consequences, with those experiencing financial anxiety more likely to report high stress levels, less likely to follow healthy diets, and even less likely to access healthcare services.

What are three innovative policy based solutions?

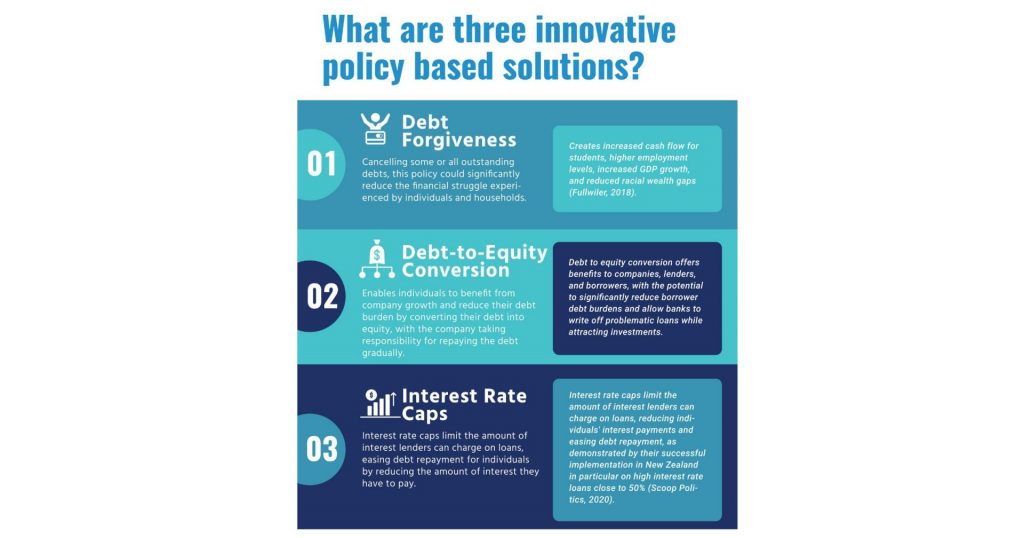

1. Debt Forgiveness

Debt forgiveness is a helpful policy that can provide relief to individuals and households with overwhelming debt. It can be achieved through a range of approaches, including bankruptcy reform, loan forgiveness programs, and government-sponsored debt relief. By cancelling some or all outstanding debts, this policy could significantly reduce the financial struggle experienced by individuals and households.

Debt forgiveness policies have been implemented in various countries to alleviate the debt burdens among different population segments. One such policy is student loan cancellation/forgiveness in the United States (Looney, 2021), which has been shown to have numerous benefits. Not only does it provide increased cash flow for students, but it also has positive effects on the economy, including higher employment levels, increased GDP growth, and reduced racial wealth gaps (Fullwiler, 2018). However these benefits are more pronounced in low income households, with research showing that debt relief or forgiveness improves cognitive functioning and reduces anxiety level in these populations. For instance, Ong et al. (2019) found that debt relief resulted in an 11% reduction in anxiety in 196 low-income households examined in Singapore.

2. Debt-to-Equity Conversion

Another innovative policy solution to personal debt is the debt-to-equity conversion. This policy would allow individuals to convert their debt into equity in a company. The company would then be responsible for repaying the debt over time. This would give individuals an opportunity to benefit from the growth of the company while reducing their debt burden.

In 1989, Blackwell and Nocera conducted a groundbreaking study for the International Monetary Fund that explored the benefits of debt-to-equity conversion. Their research uncovered a range of advantages for all parties involved, including companies, lenders, and borrowers. For borrowers, this policy has the potential to significantly alleviate their debt burden by converting their obligations to more manageable levels. For banks, this approach allows them to write off problematic loans while simultaneously attracting much-needed investments. One notable example is how banks can absorb larger losses by selling their loans or converting them to equity, such as in the case where converting a loan at a 40% loss can still yield a net profit of 20% after being sold at a 20% discount. However, it’s important to recognize that the efficacy of this policy is heavily reliant on a country’s fiscal and monetary policies, as noted by Blackwell and Nocera (1989).

3. Interest Rate Caps

Interest rate caps are another innovative policy solution to personal debt. This policy would limit the amount of interest that lenders can charge on loans. This would reduce the amount of interest that individuals have to pay and make it easier for them to repay their debts.

Interest rate caps have been implemented as a measure of consumer protection in 76 countries during the global financial crisis, according to a report by Maimbo et al. (2014) for the World Bank. The efficacy of such caps has been demonstrated in New Zealand where they have been successful in alleviating financial burdens of borrowers who had taken out high-cost loans with an interest rate exceeding 50% (Scoop Politics, 2020). Nevertheless, it is important to exercise caution when implementing such a policy as it may have unintended consequences such as an increase in non-interest fees and a decline in financial inclusion (Heng et al., 2021).

Conclusion

In conclusion, personal debt is a pressing issue that needs to be addressed as it has numerous detrimental effects on individuals, businesses and the economy. However, there are innovative policy solutions available for countries to alleviate the debt burden of their citizens. These include student loan forgiveness, debt-to-equity conversion and interest rate caps. All of these policies have been demonstrated to have various benefits including improving access to credit, reducing racial wealth gaps and alleviating financial burdens of borrowers. While there are potential drawbacks when implementing such policies, they should still be considered by policymakers as they may provide a more viable solution than traditional approaches.